Life is unpredictable, but your family's financial future doesn’t have to be!"

Query For Term Insurance?

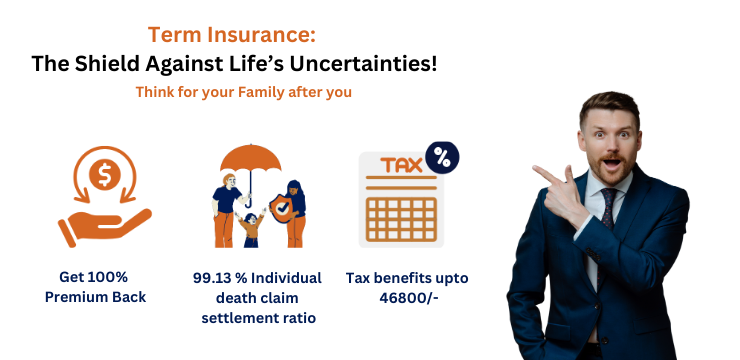

Term Insurance

What is Term Insurance ?

Term insurance is a life insurance policy that provides financial protection to your family in case of your untimely death during the policy term. It offers high coverage at low premiums but has no maturity or savings benefit. If the policyholder dies during the term, the nominee gets the sum assured. If the policyholder survives the term, nothing is paid out. It’s an affordable way to secure your loved ones’ future.

Why Term Insurance?

Life is unpredictable. While we cannot control the uncertainties of life, we can certainly prepare for them. Term insurance is the simplest and most affordable way to protect your family’s financial future in case something happens to you.

Key Benefits:

High Coverage at Low Premium: Term plans offer a large sum assured at a much lower premium compared to other life insurance options.

Financial Security for Your Family: If the policyholder passes away during the policy term, the nominee receives the full sum assured to cover expenses like children’s education, home loans, or daily living costs.

Tax Benefits: You can save on taxes under Section 80C (premium paid) and Section 10(10D) (death benefit received) of the Income Tax Act.

Example:

Meet Raj, a 35-year-old working professional. He buys a term insurance policy with a sum assured of ₹1 crore for a yearly premium of just ₹10,000. If Raj passes away during the policy term, his family will receive ₹1 crore, helping them maintain their lifestyle, pay off loans, and secure their future. If he survives the term, there’s no payout—but the peace of mind is priceless.

How to choose Right Term Insurance

Choosing the right term insurance plan ensures your loved ones are financially secure even in your absence. Here’s a step-by-step guide to help you make the right decision:

Assess Your Financial Responsibilities

List all existing liabilities: home loan, personal loans, credit card debt. Consider future expenses: children’s education, marriage, daily living costs. Tip: Your sum assured should be 10–20 times your annual income.

Decide the Policy Term

Choose a policy term that covers your working years or until major liabilities are paid off. Tip: If you plan to retire at 60, choose a term until age 60–65.

Choose the Right Coverage Amount

Don’t under-insure. Choose a sum assured that covers current lifestyle, inflation, and future needs. Use an online Term Insurance Calculator for accurate estimation.

Select the Type of Plan

Basic Level Plan: For straightforward, affordable protection. ROP Plan: For those who prefer premiums returned on survival. Joint Plan: For couples with shared responsibilities. Increasing/Decreasing Plans: Based on inflation or reducing liabilities.

Check Claim Settlement Ratio

A high claim settlement ratio (CSR) means the insurer is reliable during claims. Look for insurers with CSR above 95%, as per IRDAI.

Look for Essential Riders (Add-Ons)

Accidental Death Benefit Critical Illness Cover Waiver of Premium on Disability These enhance your coverage for a minimal extra premium.

Compare Premiums & Features

Don’t just go for the cheapest. Compare benefits, riders, claim process, and support quality. Use trusted comparison portals or consult an advisor.

Buy Early

The younger you are, the lower your premium. A healthy 25-year-old pays far less than a 40-year-old for the same cover.

Disclose Honestly

Always disclose medical history, lifestyle habits (like smoking), and income. False information can lead to claim rejection.

Factors That affect Term Insurance Premiums

1. Age

Younger = Lower Premiums

The earlier you buy, the cheaper it is. As age increases, so does the risk, and therefore, the premium.

2. Health Condition

Medical History Matters

Pre-existing conditions like diabetes, hypertension, or heart disease can increase premiums.

Insurers may require medical tests before approval.

3. Lifestyle Habits

Smokers & Drinkers Pay More

Smoking, alcohol consumption, or a sedentary lifestyle can raise your premium due to higher health risks.

4. Occupation

Risky Jobs = Higher Premiums

People working in hazardous environments (mining, aviation, chemical industries) usually pay more.

5. Policy Term & Sum Assured

Longer Terms & Higher Cover = Higher Premiums

A ₹1 crore policy for 30 years costs more than a ₹50 lakh policy for 20 years.

6. Gender

Females Often Pay Less

Statistically, women live longer than men, which can result in slightly lower premiums.

7. Add-on Riders

More Riders = Slightly Higher Premiums

Critical illness, accidental death, and disability riders add valuable protection but also increase cost.

8. Family Medical History

Genetics Can Influence Risk

If your family has a history of chronic illnesses or hereditary conditions, it may affect your premium.

9. BMI (Body Mass Index)

Obesity or underweight = Higher Risk

A very high or low BMI can indicate health concerns, leading to a higher premium.

10. Payment Frequency

Monthly, Quarterly, or Annually

Annual premiums may offer discounts compared to monthly installments.